Welcome to my February 2025 newsletter.

I was nervous.

Nearly three hundred people filled the room, and up on the stage was a literary agent, a magazine editor, and a conference host.”Who has a question?” asked the conference host.

A forest of arms rose into the air, blocking the stage and its guests. I wanted to make myself known to the editor, but I wasn’t sure how best to do it. He’d accepted a couple of my articles over the years and wanted to introduce myself. At other events, I’d waited until the end of these discussion panels, then hovered awkwardly near the stage along with a crowd of others, only to find the guest speaker being whisked out the back.

“And,” the conference host’s voice pierced my thoughts, “when you ask a question, please state your name and where you’re from first.”

Well, that was it then. I had to ask a question.

Every time the panel finished answering one question, my hand shot in the air. Every time my hand shot up, the moderator selected someone else to ask their question.

I was about to give up when—

“That gentleman over there has raised his hand several times.”

Someone thrust the roving mic in front of my face. “Hi, I’m Simon Whaley from Shropshire, and my question is—”

I remember the editor smiling as he and the literary agent listening to my question, and then answered it.

“Sadly, that’s all we have time for,” the organiser said, just as another forest of arms shot into the air. “I’d like you all to join me in thanking them for such a wonderfully informative session.”

The applause echoed off the walls and ceiling, and many delegates got up to leave. I dithered about what to do next. When I reached the end of the row of chairs I’d been sitting in, I saw the editor waiting for me, hand outstretched.

“Simon, lovely to put a face to the name.”

And that’s how I first met the then editor of Writing Magazine.

That was 2010. He subsequently bought several articles from me, and in 2014 commissioned me to write the Business of Writing column that I still write for the magazine today.

You never know what might happen when you attend a writers’ conference. Indeed, at the same conference, I’d been tutoring a course on writing for magazines, and one of my course delegates sounded me out about an idea for a collection of articles for Writing Magazine. I thought they were brilliant, and while the editor and I were chatting, she passed by, so I grabbed her and said, “Tarja’s got some great ideas for the magazine.”

The editor was interested, and later, not only did he take her ideas, but it became a column for her too, which still runs today.

This year’s Swanwick Writers’ Summer School runs from 9th to 14th August this year, and I’ll be there again, running a series of workshops on Creative Non-Fiction. They also run a TopWrite scheme for writers under the age of 30, who can book a place for £150 (instead of the usual £775). Numbers are limited, but you never know what might happen. (Tarja was one of the TopWrite delegates in 2010.)

If you’ve never been to a writers’ conference before, my top three tips are:

Don’t worry about not knowing anyone. You’re at a writers’ conference, so you immediately have something in common with everyone else there.

Take three different colour highlighter pens. Use one to highlight workshops and talks you definitely want to see, use another to highlight those you’d like to attend, and use the final colour to highlight those you’d like to attend if you still have the energy. (You won’t. Because it’s such a fun way of learning, and meeting new writing friends, these conferences can be mentally exhausting.)

Treat yourself to a posh notebook and take it with you. That way, all your notes from workshops and talks will be in one place, and easy to refer to later.

Tax Interviews

I recently delivered a series of six webinars for Writing Magazine/Writers Online exploring self-publishing, and in the last one, I went through the process of completing the Tax Interview on Amazon. The phrase “tax interview” is quite daunting, yet the process is straightforward, so I thought I’d share it here.

The reason those of us outside the US have to complete the tax interview is because companies like Amazon and Google as US companies and their Internal Revenue Service (IRS) requires them to withhold up to 30% of any money earned by non-US citizens, unless they’ve completed a tax interview. The interview checks that the non-US citizen lives in a country that has a tax agreement with the US. Effectively, it allows us to pay tax on our earnings generated through US companies to our government rather than the US Government.

On Amazon, it’s relatively straightforward. Go to Your Account in the KDP Dashboard and then select Tax Interview on the left.

Then select Update/Access Tax Profile.

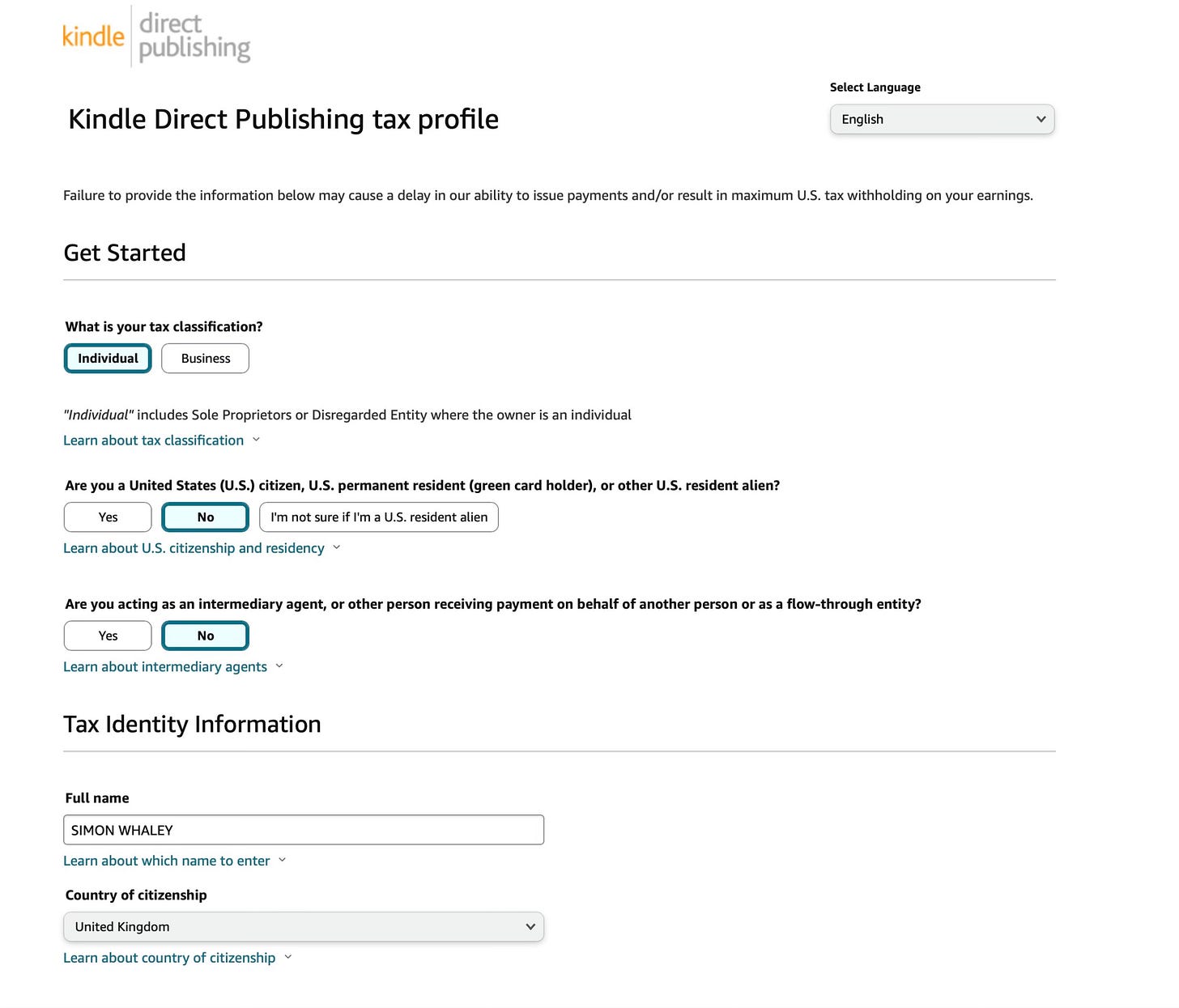

We’re then presented with the tax interview form. For most writers, we should select that we are an Individual. (If you have set yourself up as a limited company, then choose the Business option.)

The second question asks if you are a US Citizen. Select No if you’re not (which is why we have to complete these forms in the first place!).

The third question asks if you’re acting as an intermediary agent. Self-published writers should tick No because we’ve earned the money in our name, and Amazon (or Google, etc) will pay it directly to us.

Next come some easy questions: name and country of residence. Easy. (Hopefully.)

Scrolling down the page, we’re then asked for our British Tax Identification Number. Here in the UK, we have two choices: our UTR, or our National Insurance Number. Our UTR (Unique Tax Reference Number) is a 10-digit number and you’ll find it on any correspondence you have from HMRC. If you don’t have any HMRC correspondence, then use your National Insurance number and select that option from the dropdown menu (circled in red).

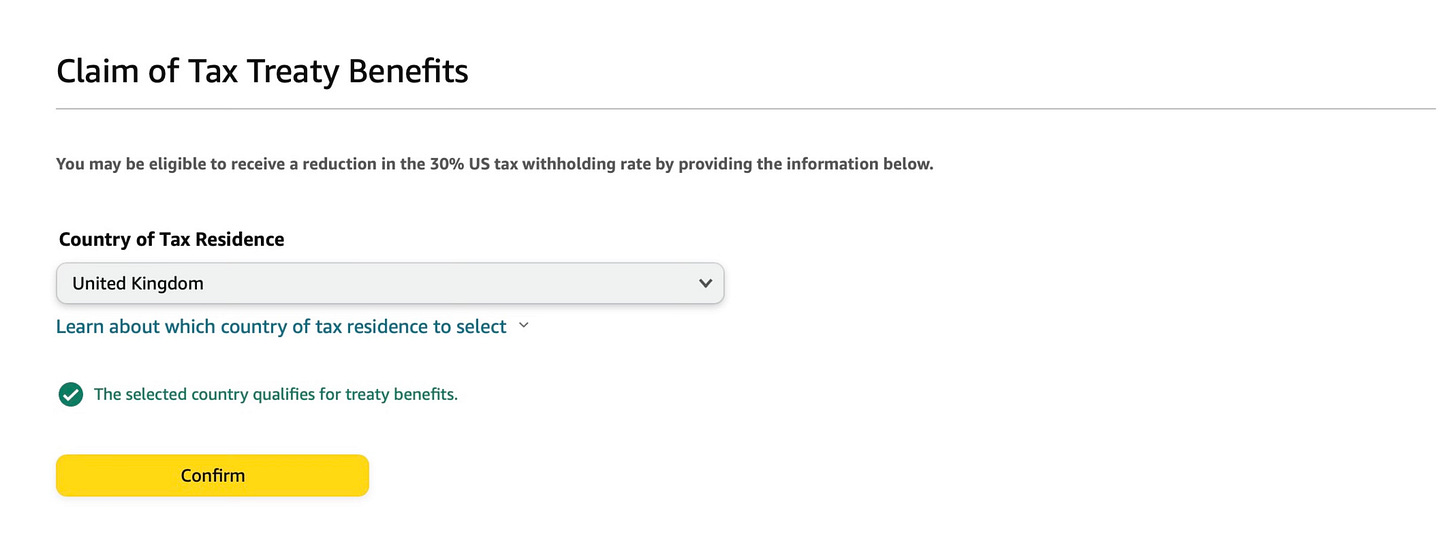

Continue and then select your Country of Residence.

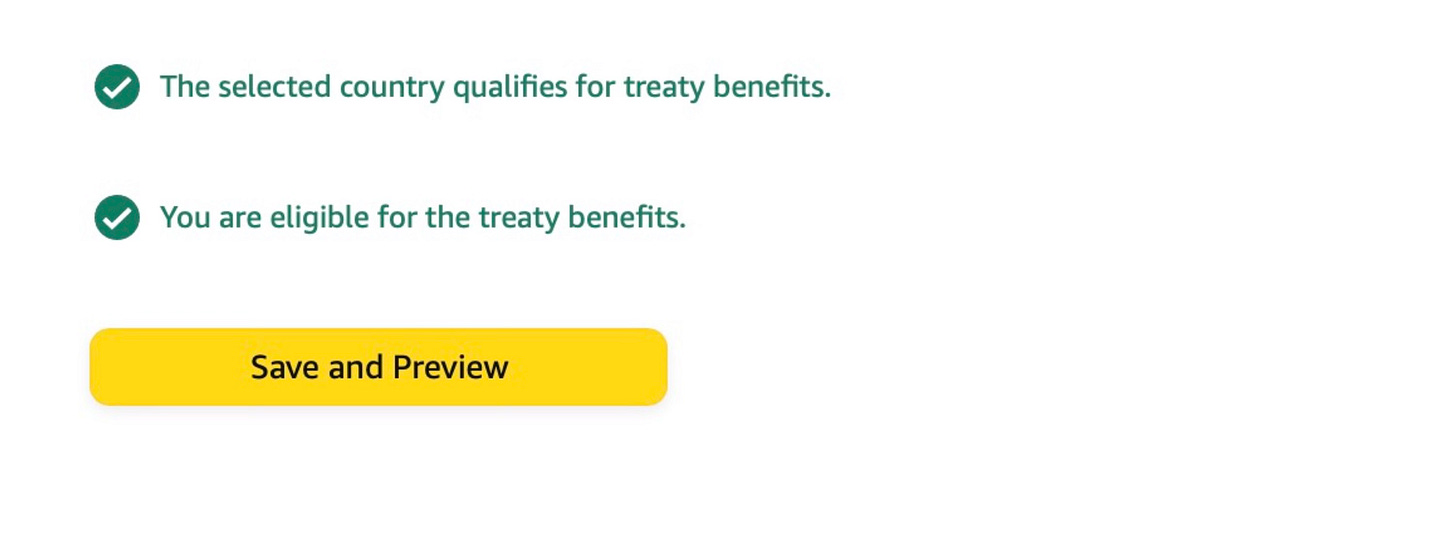

When you’ve confirmed that, you’ll see a screen confirming whether your country of tax residence has a tax treaty with the US.

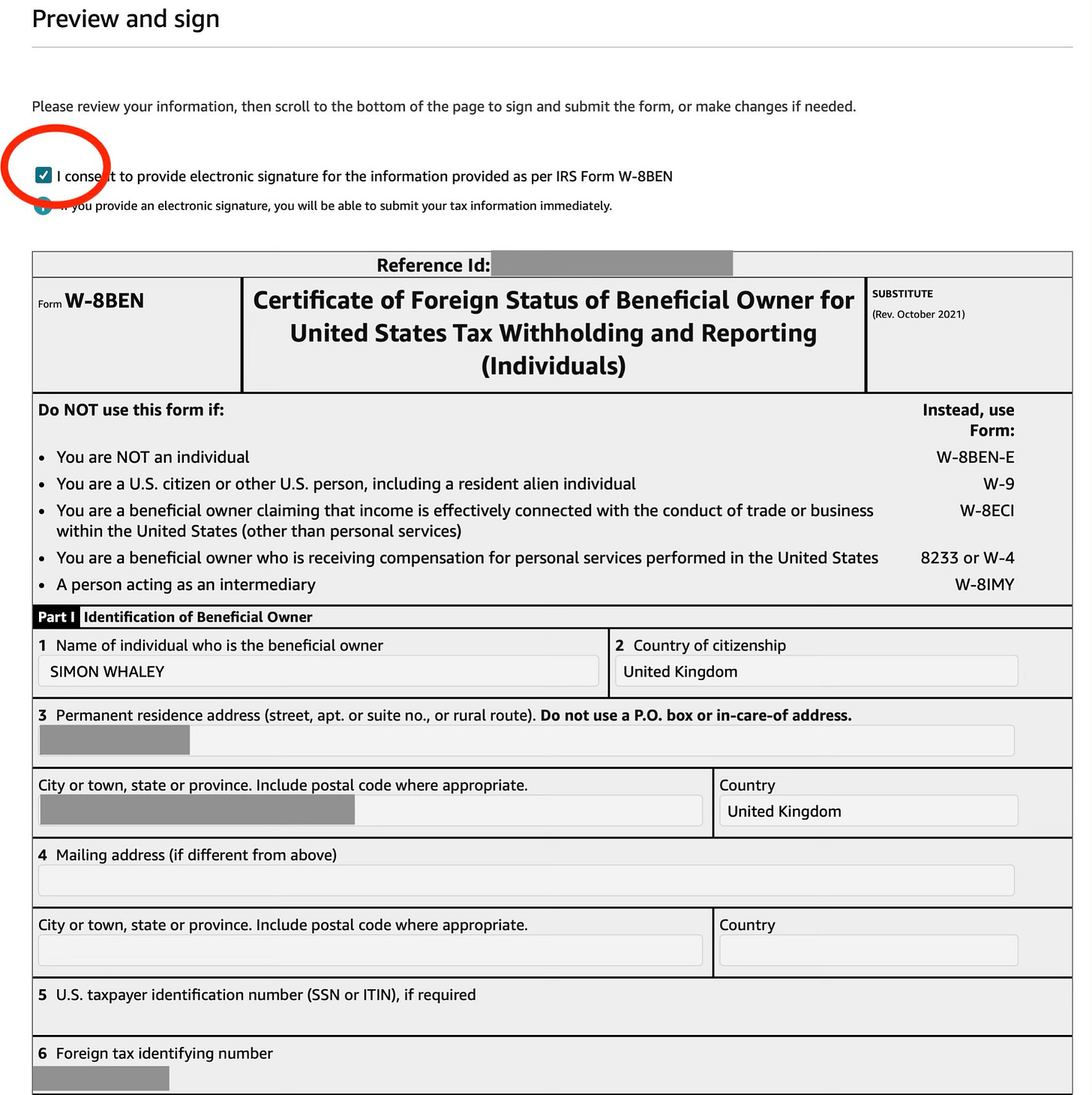

On the screen next appears a digital version of the form W-8BEN, with all of this information populated. Above this, though, is a checkbox regarding whether you’re happy to sign this form digitally. If you’re not happy with this, leave the box unchecked, review the form, then you’ll be given an option to download it, print it off, sign it manually, after which you’ll need to post it back to the USA. (Bear in mind that you will still be subject to up to a 30% reduction in royalties until Amazon has verified your signed document.)

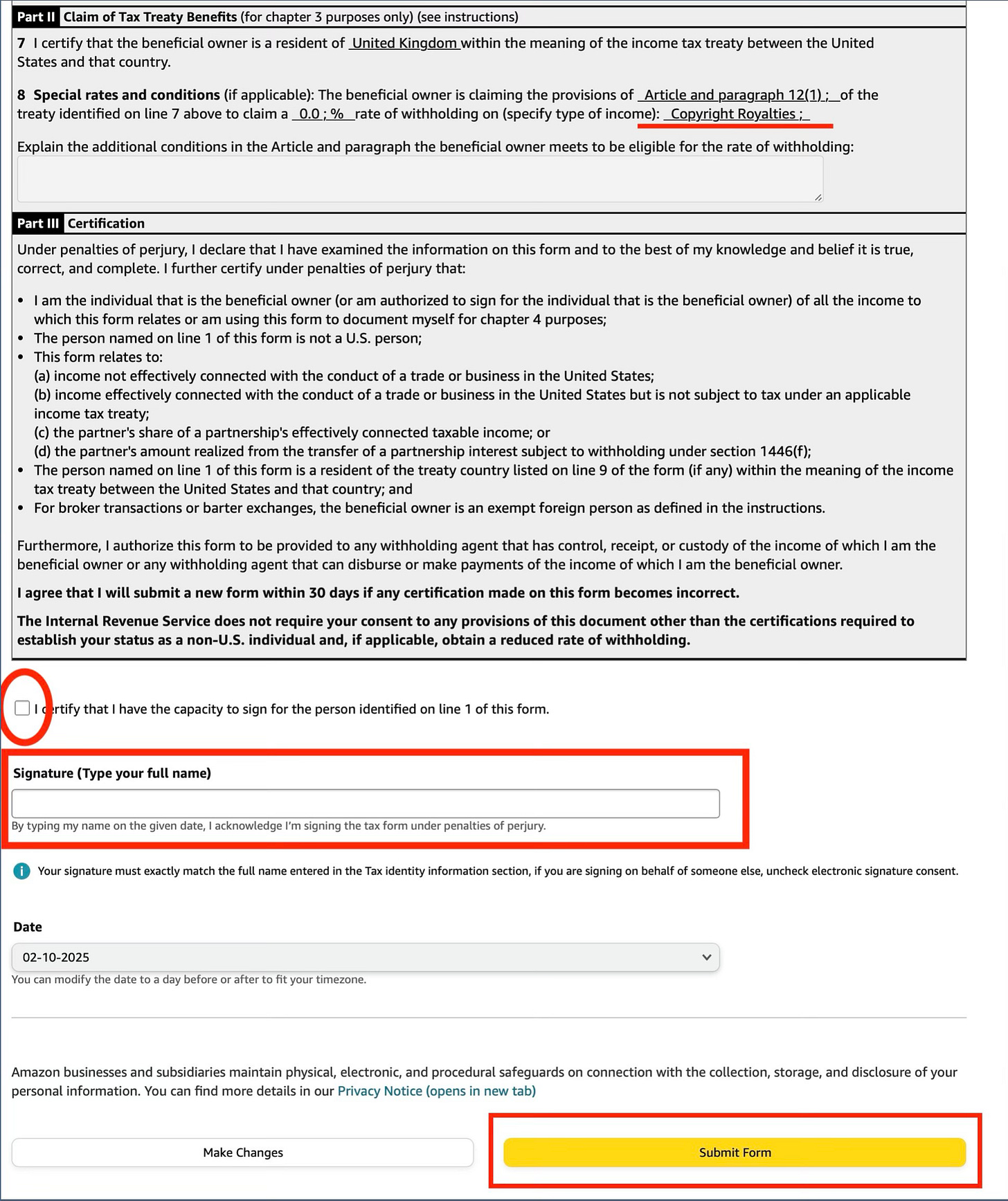

If you are happy to sign this digitally, tick the box, check the information contained on the form is accurate, then scroll down, and tick the box to confirm you have the mental capacity to sign this form.

To sign the form digitally, all you have to do is type your name into the box highlighted by a red rectangle.

Click on the yellow Sumit Form button and you’re done.

In most circumstances, all checks will be made electronically, and your Account updated to show you can receive your royalties in full, with no Withholding Tax applied.

These forms are valid for three years, so you will be contacted before they expire and asked to complete the interview again. However, all you need to do is check the information is still correct and up-to-date.

And that’s all there is to it!

Upcoming Events.

NAWG Webinar: Writing for Magazines. On 19th March, I’m facilitating a webinar on behalf of NAWG (National Association of Writers and Groups) on Writing for Magazines. If you happen to be a NAWG member and you’ve not written for magazines before but want to know where to start, or if you have dabbled and want to consolidate their knowledge, then this 2-hour webinar could be just what you’re looking for. Cost £15. Book directly with NAWG here.

The Crafty Art of Creative Non-Fiction. As mentioned earlier, this is the course I shall be tutoring at Swanwick this year. For more details, click here.

A couple of days ago, I was a guest on The Write Club Podcast. I hope to be able to share the link with you next month.

Until then, keeeeeeeeeep writing!

Best wishes,

Simon

Brilliant and informative, as ever. Good to see The Hayes Centre in all its glory. Fond memories!